The Advantages of Submitting an Online Tax Return in Australia for Faster Processing and Refunds

Navigate Your Online Tax Obligation Return in Australia: Important Resources and Tips

Browsing the on the internet income tax return process in Australia requires a clear understanding of your obligations and the sources available to streamline the experience. Vital files, such as your Tax Obligation Documents Number and revenue declarations, need to be thoroughly prepared. In addition, picking a suitable online system can dramatically impact the performance of your filing process. As you take into consideration these factors, it is important to also understand usual pitfalls that many encounter. Comprehending these subtleties could inevitably conserve you time and decrease tension-- causing an extra favorable result. What techniques can best help in this venture?

Comprehending Tax Obligation Responsibilities

Recognizing tax obligation responsibilities is necessary for people and organizations running in Australia. The Australian taxation system is regulated by various legislations and regulations that require taxpayers to be knowledgeable about their duties. People should report their revenue precisely, that includes salaries, rental income, and investment earnings, and pay tax obligations as necessary. Residents have to recognize the difference between taxed and non-taxable income to make sure compliance and maximize tax results.

For companies, tax obligation obligations incorporate several aspects, including the Goods and Provider Tax Obligation (GST), firm tax, and pay-roll tax obligation. It is important for services to register for an Australian Company Number (ABN) and, if applicable, GST registration. These duties require precise record-keeping and prompt entries of income tax return.

In addition, taxpayers should be acquainted with readily available reductions and offsets that can relieve their tax obligation problem. Looking for advice from tax experts can offer important understandings right into optimizing tax placements while making certain compliance with the legislation. On the whole, a detailed understanding of tax obligations is crucial for reliable monetary planning and to avoid fines associated with non-compliance in Australia.

Important Papers to Prepare

Furthermore, put together any pertinent financial institution declarations that mirror rate of interest earnings, along with reward statements if you hold shares. If you have various other incomes, such as rental buildings or freelance job, guarantee you have records of these earnings and any associated expenses.

Do not fail to remember to consist of reductions for which you may be eligible. This might involve invoices for occupational costs, education and learning expenses, or charitable donations. Think about any kind of exclusive wellness insurance statements, as these can affect your tax obligations. By collecting these crucial records beforehand, you will certainly streamline your on the internet tax return process, minimize mistakes, and maximize potential refunds.

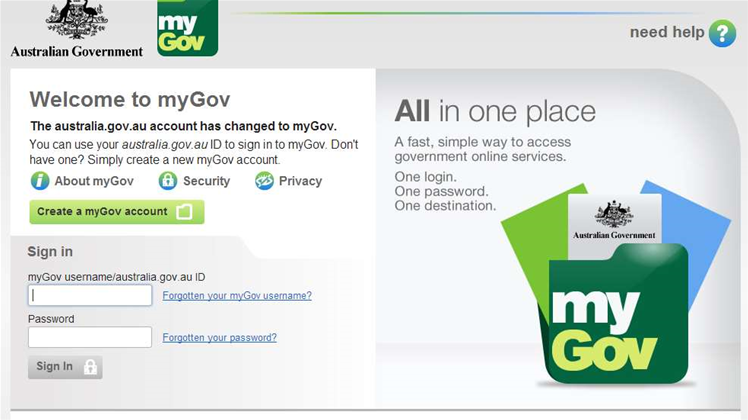

Choosing the Right Online Platform

As you prepare to file your on the internet tax return in Australia, picking the best platform is essential to guarantee precision and convenience of usage. A simple, intuitive layout can dramatically boost your experience, making it less complicated to navigate complicated tax types.

Following, assess the platform's compatibility with your economic situation. Some solutions cater specifically to individuals with simple tax obligation returns, while others give detailed assistance for more complicated situations, such as self-employment or financial investment income. Look for platforms that offer real-time mistake monitoring and guidance, aiding to minimize errors and guaranteeing compliance with Australian tax regulations.

One more crucial facet to consider is the level of consumer assistance readily available. Dependable platforms should supply accessibility to support through email, phone, or conversation, specifically during optimal declaring periods. In addition, research study customer testimonials and ratings to evaluate the total fulfillment and reliability of the system.

Tips for a Smooth Filing Refine

Submitting your on the internet income tax return can be an uncomplicated process if you comply with a couple of essential pointers to make certain efficiency and precision. First, collect all required files before starting. This includes your earnings declarations, receipts for reductions, and any kind of various other relevant documents. Having every little thing at hand reduces disturbances and errors.

Next, make the most of the pre-filling function used by lots of on the internet platforms. This can conserve time and decrease the opportunity of errors by immediately occupying your return with information from previous years and data supplied by your employer and monetary organizations.

Additionally, double-check all entries for precision. online tax return in Australia. Blunders can result in delayed refunds or problems with the Australian Taxes Workplace (ATO) Ensure that your personal information, income figures, and deductions are proper

Be conscious of target dates. If you owe taxes, filing early not just lowers anxiety yet additionally permits for far better preparation. Lastly, if you have questions or unpredictabilities, speak with the help sections of your chosen system or seek expert recommendations. By complying with these tips, you can browse the online income tax return procedure efficiently and confidently.

Resources for Aid and Assistance

Browsing the complexities of on the internet income tax return can occasionally be daunting, but a selection of sources for support and support are readily available to assist taxpayers. The Australian Tax Office (ATO) is the main source of details, providing extensive guides on its site, consisting of FAQs, training videos, and live conversation options for real-time aid.

Additionally, the ATO's phone assistance line is available for those who choose direct communication. online tax return in Australia. Tax obligation professionals, such as licensed tax obligation agents, can likewise give tailored guidance and ensure compliance with current tax laws

Final Thought

In final thought, properly navigating the on-line tax return procedure in Australia needs a detailed understanding of tax responsibilities, careful preparation of necessary records, and cautious selection of a suitable online platform. Following practical suggestions can enhance the filing experience, while available sources supply beneficial support. By coming close to the procedure with persistance and interest to information, taxpayers can make sure compliance and optimize check here potential advantages, ultimately adding to an extra successful and effective tax return result.

As you prepare to submit your on the internet tax obligation return in Australia, choosing the ideal system is necessary to guarantee accuracy and convenience of use.In conclusion, properly browsing the online tax obligation return procedure in Australia calls for a complete understanding of tax obligations, precise preparation of important records, and cautious selection of an appropriate online platform.